The British Virgin Islands is now removed from the French list of non-cooperative tax jurisdictions.

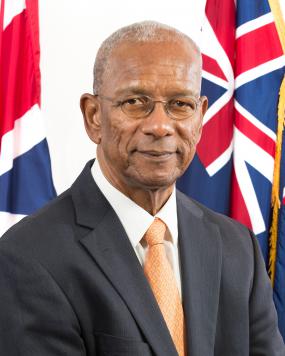

Premier and Minister for Finance, Dr. the Honourable D. Orlando Smith, OBE said he is pleased with this announcement, which came on Monday, December 21 by the French Minister of Finance and Public Accounts, Michel Sapin.

Minister Sapin signed a Ministerial decision to remove the Virgin Islands from the French list of non-cooperative tax jurisdictions.

In a press release issued, Minister Sapin explained that the cooperation between France and the Virgin Islands progressed very significantly which resulted in almost all of the requests being successfully responded to.

Honourable Premier said, “The Government of the Virgin Islands is pleased with this positive step from France which demonstrates our commitment to exchange of information and also demonstrates our compliance with the international standards.”

He added, “As a jurisdiction, we have always, through the continual review and reform of the appropriate legislative and administrative frameworks, strived to ensure that our regime is fit for purpose, internationally compliant, and can serve the legitimate business needs of our industry’s clientele.”

He further explained that the BVI has long given due regard to the developing global trends which impact or have the potential to impact the Territory’s financial services sector including the current global issues related to transparency.

“My Government will continue to do what is necessary to strengthen our law enforcement, international cooperation and effective exchange of information in the areas of tax, to keep in tune with developments and guard against activities considered inimical to the financial services sector and the reputation of the Territory,” Premier Smith said.

The announcement comes after the progress made in the Virgin Islands was also recognised by the Global Forum on Tax Transparency and Exchange of Information for Tax Purposes in August, 2015 which saw an upgrade of the Territory’s non-compliant rating to ‘largely compliant’.

The Virgin Islands had in 2012 after an internal review introduced the International Tax Authority (“ITA”) which is the unit responsible for exchange of information. This unit developed systems, processes and procedures to ensure that all requests for information could be fully answered. The Virgin Islands remains committed to the international standard and will continue to maintain this high level of communication and assistance in exchange of information with our treaty partners.